As a business grows, it faces challenges. Processes break down, data floods in from all directions, and technology bottlenecks get in the way of making decisions quickly. Traditional enterprise resource planning (ERP) solutions can make these problems worse. As a CFO, you may be tempted just to shore up existing systems. With a modern, cloud-based solution, however, you gain the agility and scalability you need to grow at the speed of opportunity.

The financial services sector is an ever-evolving one. It faces many challenges, some of which are IT-related. If you use Microsoft Dynamics 365 Finance, you can gain complete visibility into your spending and costs by integrating a predictive and proactive financial management tool. Adding a financial management software tool to your process ensures that you eliminate human error and tedious work processes while boosting productivity.

What is Microsoft Dynamics 365 Finance?

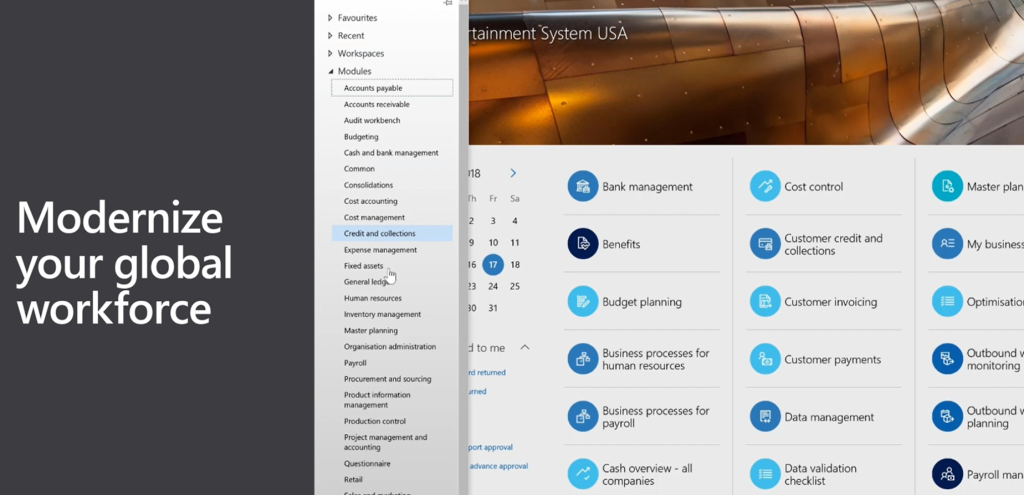

Dynamics 365 Finance is a cloud-based ERP solution geared toward large businesses that want to maximize financial visibility and modernize their financial operations. D365 Finance offers full control over finances, including the general ledger, accounts payable and receivable, and bank reconciliation capabilities.

It offers capabilities for fixed asset management and month-end closing. It is a comprehensive financial management solution that simplifies and improves planning and budgeting.

Microsoft Dynamics 365 Finance lets you tap into your company’s historical financial data, so CFOs can forecast future trends and make informed decisions to accelerate growth. Besides, Dynamics 365 Finance lets your workforce access the tools they need from any device. Organizations can streamline reporting with the Artificial Intelligence (AI)-powered tools in Dynamics 365 Finance.

How Dynamics 365 Finance Empowers Adaptability with CFO

The chief financial officer’s role has evolved from reporting on past performance to helping bring about future success. During the pandemic, finance leaders often took ownership of large-scale digital transformation efforts––a trend that is continuing today. One of the biggest challenges we have faced in the past two years is learning to adapt quickly to changing situations.

Although we may have moved into a post-pandemic world, disruptive events such as natural disasters and economic downturns will continue to happen.. As new business models evolve, such as the subscription economy and service-based experiences like platform-as-a-service (PaaS), companies must embrace significant changes to their financial and operational models.

Let us have a look at the major forces driving the adaptability of CFOs towards Dynamics 365 Finance,

Upgrade Enterprise Resource Planning Software

The first force driving ERP adaptability is the shift from monolithic to composable business applications. This technological change has been made possible by recent advances in the fields of information technology and cloud computing.

Dynamics 365 Finance offers businesses standardized capabilities on a composable ERP platform, as well as the ability to function as both a stand-alone solution and as an extensible system. As CFOs look to modernize existing ERP solutions, Dynamics 365 is helping them unlock adaptability and improve IT agility.

Enable a single source of truth in real-time

Although expensive to maintain and resource-intensive to customize, legacy ERP often becomes highly customized and fragmented as businesses grow. Without a unified enterprise resource planning (ERP) system, finance leaders are unable to access all of their organization’s data in real-time, which makes it difficult for them to act as innovators and strategists for their companies.

Dynamics 365 Finance is built on a modern, open platform that enables data integration between legacy systems and modern cloud-based solutions. It allows finance teams and the broader organization to make quicker, data-first decisions by providing a flexible, open platform with RESTful APIs.

AI-Driven Insights

Dynamics 365 Finance has announced that finance insights are now generally available. Intelligent automation capabilities help companies improve the efficiency and quality of financial processes. Finance insights provide three new financial management tools, which combine with Dynamics 365 Finance to improve business decision-making. These tools provide AI-driven business insights that are clearer and faster while also improving operational efficiency by utilizing intelligent automation.

Capabilities of Dynamics 365 Finance in Accounting and Financial Management

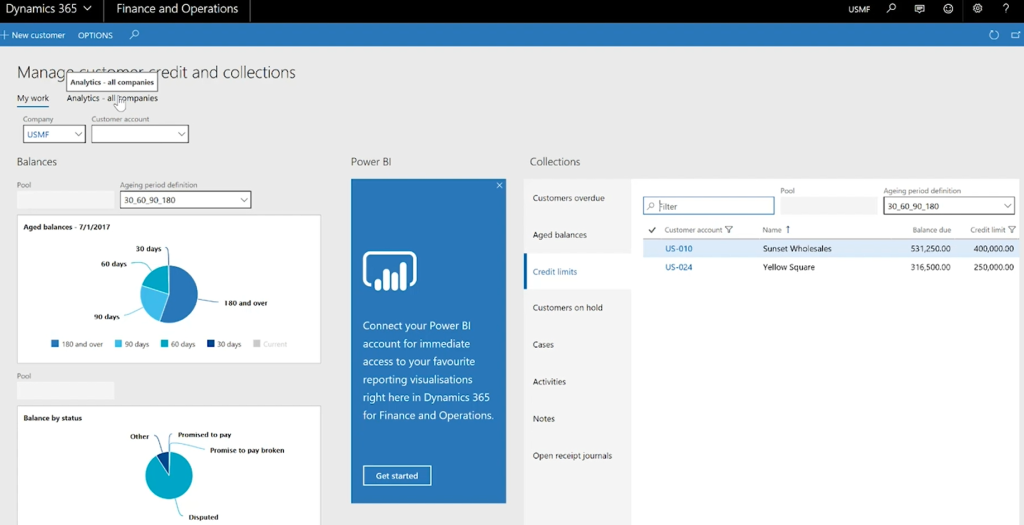

Dynamics 365 Finance can help CFOs get a comprehensive view of their company’s financial health, including the essential financial KPIs, charts, and metrics to enhance account reporting efficiency, and growth.

Here are some of the capabilities offered by Dynamics 365 Finance to the CFOs,

- Simplified Finance Management: Dynamics 365 Finance helps CFOs in closing books faster with its in-depth financial reporting capabilities and support of multiple legal entities and currencies.

- Unified and Automated Financial Processes: Dynamics 365 Finance helps you automate the process of submitting invoices, matching vendor invoice lines to produce receipts, and managing credit risks and collections. It allows CFOs to create rules and prediction-based collection automation which ultimately accelerates on-time payment and improves cash flow.

- AI-Powered Insights to Make Strategic Financial Decisions: Finance insights bring artificial intelligence and automation capabilities to Dynamics 365 Finance, such as customer payment predictions and automatic budget proposals. It can also help you forecast cash flow by predicting which payments may be late, allowing CFOs to proactively reach out to at-risk customers. To make budgeting easier, CFOs can use historical data and trends to predict future budgets. And if you’re creating cash flow projections, you might want to use AI, unified data, and “what if” analysis.

- Automated Recurring Billing: D365 Finance makes it easier for your organization to thrive in the subscription-based economy. It automates recurring billing, which saves time and money, reduces audit costs, and accurately calculates and reports your financial statements.

- Minimize Financial Complexity and Risk: D365 Finance helps CFOs in complying with their global tax needs, including easier tax calculation, reporting, and payments. It’s easy to comply with local regulations using a no-code flexible tax-determination matrix and tax-calculation designer.

- Manage Growth Efficiently: Dynamics 365 Finance allows you to quickly deploy new subsidiaries and product lines. It also has a feature called onboarding, which enables CFOs to quickly copy an existing legal entity’s setup to a new entity.

Benefits for CFOs in Using Dynamics 365 Finance

With Dynamics 365 Finance, CFOs can ensure enterprise-wide visibility and unify the company’s data, speed up business process evolution, and enable employees to do business nearly anywhere on any device. In short, Dynamics 365 Finance is helping companies to grow faster, smarter, and better.

Cloud Benefits

Cloud-based Dynamics 365 offers a lot of benefits for businesses as cloud-based ERP solution. It means you get automatic software updates, a lower cost of ownership, and improved collaboration and agility. And the flexibility to work on your schedule is a huge plus. With cloud technology, you can run your business from anywhere, regardless of location. Today, remote work is becoming a new normal, and flexibility is key to keeping your business competitive.

Integration with Other Microsoft Products

If you already use Microsoft business applications, you will find Dynamics 365 Finance and Business Central to be powerful solutions that seamlessly integrate with other Microsoft applications, including BI, CRM, IoT solutions, productivity software, etc. Personalization and training costs can be reduced by using both solutions. You can also add additional functionality to both through extensions available in the Microsoft AppSource, an online store for third-party add-ons and integrations.

Data Security and Compliance from Microsoft

Microsoft is committed to protecting your business data, and they’ve developed the Dynamics 365 platform with security in mind. Dynamics 365 Finance comes with built-in backup and recovery features to help keep your business data safe.

The system has many features, such as authorization, authentication, and data encryption, to protect the security of your business. In addition to this, it enables users to adjust settings for global businesses so that their data is collected and stored in ways that comply with local laws. MS Dynamics 365 Finance offers built-in disaster recovery, 24-hour technical support, and more.

Proactive Guidance and Predictive Modeling

Microsoft Dynamics 365 Finance provides tools to help you make better, more informed decisions. The system uses machine learning to suggest actions based on your company’s financial data, and it offers real-time analytics and well-organized reports to help you keep track of your finances. Reduce your bad debt and improve your bottom line by using an intelligent and customizable cash flow–forecasting solution to understand when your customers will pay their invoices.

EPC Group as Your Dynamics 365 Finance Consulting Partner

When it comes to options between Dynamics 365 Finance and Business Central, do not look beyond Dynamics 365 Finance. If you do high volumes of international, global, or multi-jurisdictional transactions, operate in multiple tax regions, and need high levels of traceability, upgrading to Dynamics 365 Finance has immense benefits for you. With EPC Group Dynamics 365 Finance consulting services, we can help you get your implementation or migration off the ground and running. Our MS Dynamics 365 Finance consultants provide moment-by-moment visibility into performance and analytics to help you make smarter, faster decisions as your business transformation partners.